Ten Year Equity Income Returns (Part 1)

Lessons From 10 Year Equity Income Returns

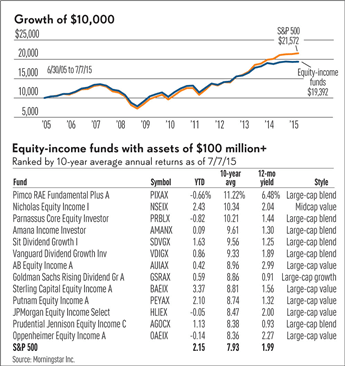

Investor’s Business Daily recently ran an article on the 10 year returns of equity income mutual funds vs the S&P 500.

The equity income mutual funds averaged 6.85% a year (some did much better) vs the S%P 500’s 7.99% over that period.

“A $10,000 investment in the average equity-income mutual fund on June 30, 2005, would have grown to $19,392 by July 7 this year, according to Morningstar Inc. data.”

The same funds invested in a S&P 500 index fund, yielded $21,572.

While we do not provide investment advice, we do use this information to make informed decisions about income generation.

The first take away is that if we earn 7% a year on an investment, we will double our money in ten years.

Second if we review the chart above, we will notice that there was substantial risk involved in holding this investment – it was cut in half from it’s peak during the economic downturn of 2008.

A strategy of many investors is to take half of the money out of an investment once it doubles. By doing this, the investment becomes risk free since all initial capital has been returned. It is much easier hold volatile (riskier) investments when using ‘house’ money.

We will revisit this chart in future articles since there is much more to learn from the data.

You can check out the original article at IBD.

Thank you Morningstar for the image and data.

View Large Image