Considering Currency Devaluation

Truth is, it’s a dog-eat-dog world since the beginning of time. Competition is toughest as time flies faster. It is about preserving one country’s wealth over another. Economists and analysts know the unwritten, underlying reasons behind these events. Sad but true, self-interests tower over to preserve one’s riches. Because wealth amassed puts power at its peak. Thus, the crisis continues.

Truth is, it’s a dog-eat-dog world since the beginning of time. Competition is toughest as time flies faster. It is about preserving one country’s wealth over another. Economists and analysts know the unwritten, underlying reasons behind these events. Sad but true, self-interests tower over to preserve one’s riches. Because wealth amassed puts power at its peak. Thus, the crisis continues.

How can one survive wealth preservation amidst crises and chaos?

Consider currency diversification. As defined, it is using more than one currency as an investing or financing strategy to allow less risk in exchange rates as compared to a single foreign currency. Buying stocks that trade in different denominations like the U.S. dollars, British pounds, Japanese yen and euros. One employs a currency diversification strategy to reduce the risk involved.

Among the rich, London’s Rothschild Dynasty upholds currency diversification strategy.

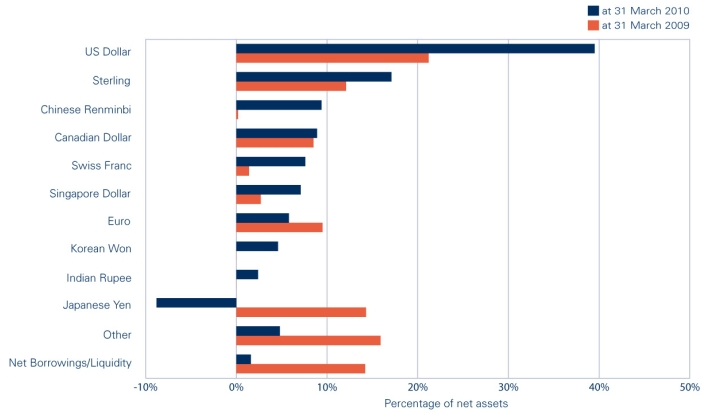

Image Credit Monevator

See how the trust changes its exposure to various currencies from one year to another. This isn’t about trying to make money from currency fluctuations as it is about the preservation of wealth.

One doesn’t have to be super affluent to preserve one’s monies via this tool. As long as one has the means, the idea is to diversify, and it can be done easily with currency ETFs (exchange traded funds).

In a Fortune article written years back that still holds true now:

Among the world’s major currencies there are substantial moves for and against the dollar that give opportunities to augment value, and they are commonly disregarded.

There are other ways to invest in currencies. Among them are high-frequency trading strategies and currency hedges for long-term investors.

Indeed, there is more to currencies than meet the eye.